Report Shows That Stablecoin Issuers Have US Debt Of $80B

A recent report by investment platform JPMorgan reveals that Circle, Tether, and other stablecoin issuers have a short-term US debt of over $80 billion in May. This figure is higher than the debt owned by Berkshire Hathaway, a company owned by Warren Buffett.

Stablecoin Firms Had Debt Of $80B In May

Issuers of stablecoins such as Circle and Tether have accumulated many shares in the US Treasury market. They have also outperformed several conventional finance players in the market.

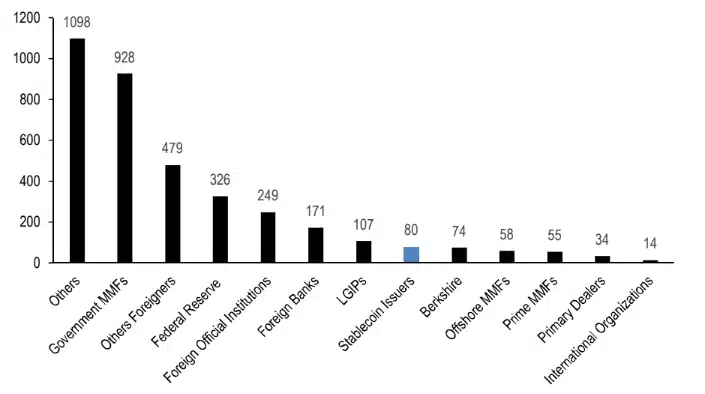

Last week, investment firm JPMorgan released a study that highlighted the debt held by several firms. All stablecoin issuers in May 2022 held a short-term US debt of over $80 billion.

Circle, Tether, and other stablecoin issuers held over 2% of the market for America’s Treasury bills. Also, they held more T-bills shares than the investment firm Berkshire Hathaway.

Furthermore, stablecoin issuers outperformed offshore MMFs (money market funds), prime MMFs, primary dealers, and international organizations in terms of T-bill proportion.

Investor Composition Of US Treasury Bill Source: JPMorgan

T-bills are instruments of debt firms use as cash equivalents on their balance sheets. These firms consider them to be assets with low risks.

Earlier this year, Circle and Tether noted that they would cut their dependence on commercial papers. They have been buying US Treasury bills with Tether hoping to reduce its commercial paper holdings to zero.

Tether And USDC Continue To Amass T-bills

Tether and Circle’s move to buy T-bills arose during the uncertainty surrounding stablecoins after the fall of TerraUSD. In May, Terra’s stablecoin lost its peg to the USD and crashed below $1.

Usually, algorithmic stablecoins depend on smart contracts and algorithms to support their USD backing. However, asset-backed stablecoins such as the USDC and USDT have reserve assets such as cash equivalents and normal cash.

These reserve assets help to maintain the stability of the stablecoin and stop it from depegging. As of the time of writing, CoinGecko reported that USDT’s market cap is $67.6 billion while that of USDC is $52.4 billion.

According to previous reports, the market capitalization of the stablecoin, USDC, has witnessed notable growth in 2022. However, the market dominance of Tether has been dwindling since May.

According to JPMorgan, investors are losing confidence in Tether’s stablecoin, the USDT. This is due to recent events in the crypto community, such as the fall of Terra.

Additionally, the investment bank noted that the driving force behind the adoption of USDC is its transparency. It also mentioned the asset quality of the stablecoin’s assets reserve.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.