Pangolin Review – Is Pangolin Scam or Legit?

Pangolin Review

The different feature of crypto that has continued to evolve over time has caused an explosion of interest in cryptocurrency. Through Decentralized Finance (DeFi), a financial system that is open, autonomous, and transparent is made available to everyone. While there had been a traditional financial system, the world wouldn’t have imagined a decentralized financial system where users could exercise control over their assets. Pangolin Exchange is a financial system created on a blockchain network, this Pangolin Exchange Review will provide a guide to how you can make use of the Automated Market Maker (AMMs) and how you can make use of cryptocurrency to your advantage- make a profit.

Cryptocurrency is a highly liquidated market and this is due to the number of active traders in the market that provides liquidity. Automated Market Makers are protocols aimed at decentralizing the market and making it simple to use. The availability of active users has resulted in large trading volumes and high liquidity in the Pangolin exchange. There is no doubt that the aim is to make a profit; it doesn’t matter if you are trading for a long-term or short-term.

While exchange platforms provide opportunities for users to earn and build their portfolio, Automated Market Makers (AMMs) protocols allow users to earn after they have created a liquidity pool of mostly about 0.3%. One major feature of crypto exchange is the order book which allows users to place an order or make an order and in other cases view the order history of the exchange. However, AMMs are different although it has trading pairs which makes it similar to order book.

Automated Market Maker allows users to create a market. However, trade is based on peer-to-contract. Transactions are done between a user and the smart contract so you don’t necessarily need another user before you can trade. In AMMs protocol, the price of cryptocurrency is only determined by a price algorithm. In most cases, the price of whatever assets a trader wants to buy or sell must not affect the liquidity pool. The liquidity pool must be constant because it affects the trading volume.

A liquidity pool is the totality of funds that traders must trade against. A liquidity provider is a user that adds funds to the liquidity pool and in return gets a particular percent from the trade done on the liquidity pool they created. With the automated market maker, any user can create liquidity. However, the rewards given to liquidity providers are decided by protocols. In this Pangolin exchange review, you will get to know the reward given to liquidity providers.

| Exchange Platform | Pangolin Exchange |

| Website | https://pangolin.exchange/ |

| Account Needed | None |

| Payment Method | Cryptocurrency |

| Language | English |

| Trading Volume | 24h |

| Trading Platform | Web-based |

| Customer Support | https://pangolin.exchange/faq |

What’s Pangolin Exchange?

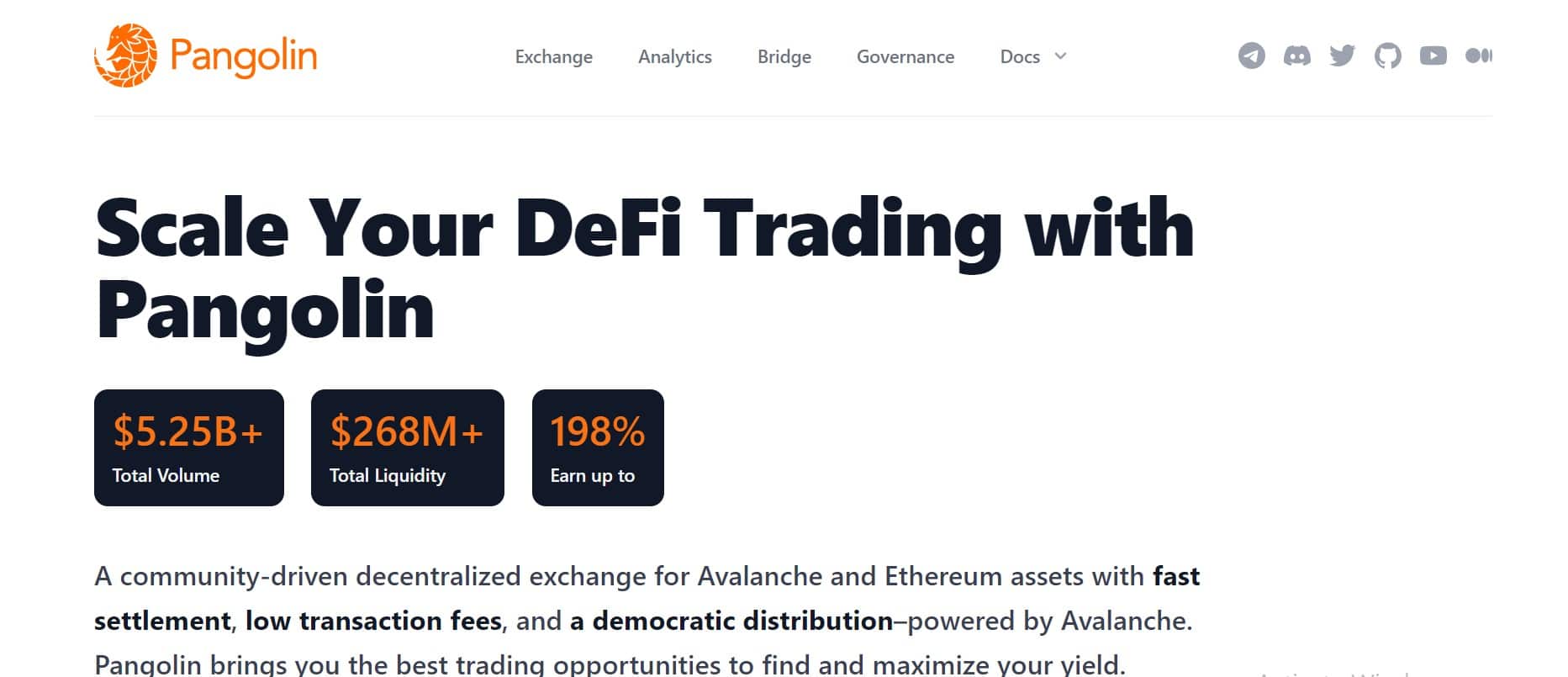

Pangolin is a decentralized exchange and an automated market maker protocol that is built on the Avalanche network which allows instant settlement of transactions and charges lower fees. The Pangolin exchange was launched in 2021. Since it is a decentralized exchange (DEXs), Pangolin ensures that users can perform transactions without any interference. So, you can fund your account without the need of a third party and you are also free to make trading decisions independently. Decentralized exchanges are known for their high level of security and you do not need to provide your personal information before you start trading. In Pangolin, you only need to connect to a wallet to start trading.

Pangolin exchange allows the trade of all the cryptocurrencies issued on Ethereum and Avalanche. Pangolin exchange ensures that users find it easy to swap from one asset to another and this is possible through the Avalanche network. One of the distinctive features of the Pangolin exchange is the PNG token which is to serves as native governance. Pangolin completely focuses on the community and the PNG token is distributed to the community without the need for a team of investors.

Pangolin is regarded as the biggest decentralized exchange on the Avalanche network and it has ensured that the satisfaction of its users is guaranteed. The interface is user-friendly and easy to use and this is to ensure that users have a good trading experience. This decentralized exchange ensures that transactions are executed smoothly and instantly. Are you still complaining about making transactions or are the transaction fees expensive? You should consider trading with Pangolin; the transaction is made easier and costs less.

Automated Market Maker (AMMs) protocol like Pangolin does not limit trading to users’ wallets alone; you can also trade with contracts. Since it is an AMM protocol, anyone can create a market and liquidity to ensure that the trading volume remains competitive and ensure that the liquidity pool remains fixed.

Also, the Pangolin exchange offers free tokens as a reward for users but they must be connected to the Avalanche wallet where they must have stored a token. This is known as an airdrop. However, you must have accessed the airdrop wallet on Avalanche before you can claim the airdrop. Just like other AMMs, the Pangolin exchange ensures that liquidity providers are rewarded. Liquidity providers are allowed to yield the PNG token and they are given a trading fee of .30%. The peculiarity of the Pangolin exchange is that it is 100% community-driven. The PNG token is directed to the community.

Pangolin exchange wants to ensure that there is no central authority or a third party. So traders can do peer-to-contract exchange.

Pangolin Trading Services

One of the distinctive features of any crypto exchange is the trading view and while there is no perfect trading view, it guides you to make a trading decision. The pangolin exchange platform has a trading view that includes all that you need to know about the exchange. It includes the price chart and the present price. The most exchange platform has order history which provides the information on the past transactions.

While most exchange platform has the order book where you can place an order for the cryptocurrency you want, Pangolin exchange platform is different. Pangolin exchange does not have an order book but it is similar to an order book because it has trading pairs like ETH. However, a trader must create a liquidity pool in which other traders must trade again to increase the liquidity rate.

Pangolin exchange allows traders to swap tokens but that’s after you have successfully connected to a wallet. Pangolin exchange does not require payment methods like credit cards or wire transfers. So, you must have an existing cryptocurrency that you can send to your connected wallet. Makers and takers of liquidity are charged 0.30%.

Pangolin exchange ensures that it is increased security and that users can store their funds and trade without the need for a third party.

Pangolin Trading Fees

Trading fees are charged based on the maker fees and the taker fees. This is because trade liquidity is influenced by these two factors. While the makers create liquidity by creating a new order book, the takers remove liquidity by choosing from the existing orders. In most cases, the takers and makers are charged differently. Some exchange platforms charge both the maker and takers the same fee known as the “flat fees.”

Although decentralized exchange does not charge users trading fees, Pangolin charges transaction fees for both liquidity provider (maker) and taker 0.30%. Users are charged trading fees to ensure that liquidity providers are rewarded for creating liquidity in the platform. The liquidity providers are also allowed to yield the PNG token. The Pangolin exchange allows the community governance to decide the fee so it is subjected to change.

Users are not charged directly on the Pangolin exchange except they make use of the Avalanche network. The trading fee for the Pangolin exchange is 0.3%. The liquidity providers are rewarded based on their contribution to the liquidity pool. So, with every share contributed to the pool the liquidity provider earns 0.3%. You can only withdraw your liquidity after it has accrued over time. Users can either decide to create a pair or add to liquidity.

While pangolin runs on the Avalanche network, users need to be connected to the Metamask wallet before they can begin operation on the Pangolin platform. You can also get the PNG token from ZT, Gate.io, and the Pangolin exchange website.

Withdrawal and Deposit Fees

The crypto market is a highly volatile market. Concerning the fees, it depends on the exchange platform. However, it is important that you study the trading fees and payment of methods before you choose an exchange platform. Pangolin exchange does not charge withdrawal fees. This is because your assets are not stored in the Pangolin wallet. However, whenever a transaction is done on the Avalanche network, you will be charged.

Traders will definitely make use of the Avalanche network to access the Metamask wallet. You can’t make use of cash deposits; you will need to make use of cryptocurrency when you want to fund your wallet. You can only swap tokens, make deposits, create or add to liquidity after you have successfully connected your wallet to the Pangolin exchange platform. One of the reasons you are likely to be charged when you make use of the Avalanche network is because of the gas which at some point skyrocketed because of the Ethereum bull.

Pangolin Wallet

Lots of centralized exchange has the wallet which allows users to store assets and trade tokens but that’s not the case with decentralized exchange. Pangolin exchange does not have a crypto wallet. The aim of Pangolin is to create a market where people can control their assets independently. While it is aimed at ensuring that users can trade cryptocurrency and also control their assets, then how does it aim to achieve that? Through Ethereum and Avalanche network, Pangolin allows users to store their assets.

While Pangolin does not have a crypto wallet, it provides users with the Metamask wallet to ensure that they can trade and also store their assets. Metamask wallet is the major wallet accepted by the Pangolin exchange platform.

If you do not have an existing Metamask account, you can always register for one then you download the app and install it on your browser extension. You can choose to make use of Google Chrome, Edge, Brave, or Firefox.

Pangolin Portfolios

Every exchange platform is aimed at ensuring that their users are able to build their platform after they have successfully created their wallets. The only criteria to start trading, earning, or building your portfolio on Pangolin is that you must have successfully connected your crypto wallet to the Pangolin website. Pangolin is aimed at retaining its customers by providing the best services.

Pangolin exchange gives any user the right to create liquidity and it also ensures that liquidity providers earn 0.3% of whatever percentage they contribute to the liquidity pool. Pangolin also allows users the chance to build their portfolio by ensuring that their rewards accrue over time before they can be withdrawn. Also, there is the airdrop which is rewarded to users that are holding existing cryptocurrency.

In a decentralized exchange like Pangolin, you do not need to open an account or drop your personal details. All you have to do is connect to a compatible wallet. When you get to the website, you will see the “connect to a wallet icon” but if you don’t have an existing wallet that you can connect to, you can create a new one. Your wallet is crucial because you need to make any transaction on Avalanche so you have to ensure that it is secured.

After you have successfully connected your Metamask to Avalanche then you will be asked to fill out some information like the network name, choose a custom RPC and ensure that the PNG token is added to your wallet. After you have successfully connected your wallet then you must fund your account.

Pangolin Limits and Liquidity

Pangolin executes transactions instantly and at a cheap price. The trading volume is 24h and there is no limit to the funds users can contribute to the liquidity pool. There are liquidity providers who ensure that liquidity is maintained and also ensure that there is a price that traders can trade against.

There is no issue of liquidity in Pangolin because it is meant to be fixed. Pangolin exchange is ranked. It has a total volume of $77,737,028 USD. The Coinmarket Cap ranks the Pangolin exchange as 726th.

Cryptocurrencies Available on Pangolin

Pangolin has trading pairs and so it ensures that there is high liquidity. About 17 cryptocurrencies and 51 trading pairs are offered in the Pangolin exchange. Pangolin allows users to swap from one token to another.

The Pangolin PNG token is also available on the platform. Some of the cryptocurrencies include; Wrapped AVAX (WAVAX/ETH), Wrapped AVAX ((WAVAX/USDT), Wrapped Bitcoin (WBTC/WAVAX), SushiSwap (SUSHI/WAVAX), DeFi Yield Protocol (DYP/WAVAX), Aave (AAVE/WAVAX), and a lot more.

Pangolin exchange does not restrict anyone from trading and US investors can also trade. While most centralized exchanges do not want to accept US investors due to the Security Exchange Commission (SEC), the decentralized exchange does because there is no need for regulation by any authorities.

Pangolin User Interface

The Pangolin exchange has an amazing user interface to ensure that the users are retained and liquidity is maintained. Pangolin is known to have three advantages; the instant settlement of transactions, low fees, and fair distribution. To ensure that users do not face any complications, the interface is made simple and fast.

Pangolin is available in the English language. While the Pangolin exchange is web-based, users can also install the Metamask on their mobile phone and personal computer. Users are also provided with an amazing trading experience. All users have access to the market and can create liquidity. The Pangolin exchange is also highly secured.

How Secure Is Pangolin Exchange?

The Pangolin exchange was built on a blockchain network to ensure that the systems and users are immune to attack. Decentralized exchange is concerned about security and is aimed at ensuring that users are not prone to risk even though they have to control their assets without external control. The perk of the Pangolin exchange is that the exchange does not have any access to your accounts and you are not obliged to provide anyone your details.

In Pangolin exchange, you do not have to worry about your funds being stolen or hacked because Pangolin ensures that your assets are inaccessible. The networks can’t be manipulated because it is spread out. The spread-out of networks is to ensure that transactions are done very fast and smoothly without having to worry about server downtime.

Customer Support

Pangolin also focuses on new traders by ensuring that the customer’s support is available within 24 hours to attend to customers when there are complications. There is an FAQ on the Pangolin exchange to provide new traders and experts with answers to whatever questions they may have. The frequently asked questions featured on the Pangolin exchange also provide users with the step-to-step guide to trading on the exchange. This is the link to access the pangolin exchange FAQ – https://pangolin.exchange/faq

You can also reach customer support on social media like Twitter, Telegram, Discord, and Github.

Conclusion

Since its launch in 2021, the Pangolin exchange has committed itself towards the community and the PNG itself was first donated to the community. It is regarded as the largest decentralized exchange and its features have been a great advantage contributing to its growth.

Since it is decentralized, all users can access the exchange and also enjoy full control of their assets. Pangolin is an automated market maker aimed at ensuring that users experience easy trade.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.