DeFi Has Successfully Passed The Correction Stress Test

When the market goes into free fall, whether you hold the Dow Jones or Bitcoin, the result is a loss, with the only difference being the amount. On May 19th, the crypto market was shaken and according to some estimates, the capitalization fell by $1.4 trillion. While centralized services showed us their true colors during this chaos, the DeFi sector has something to boast about.

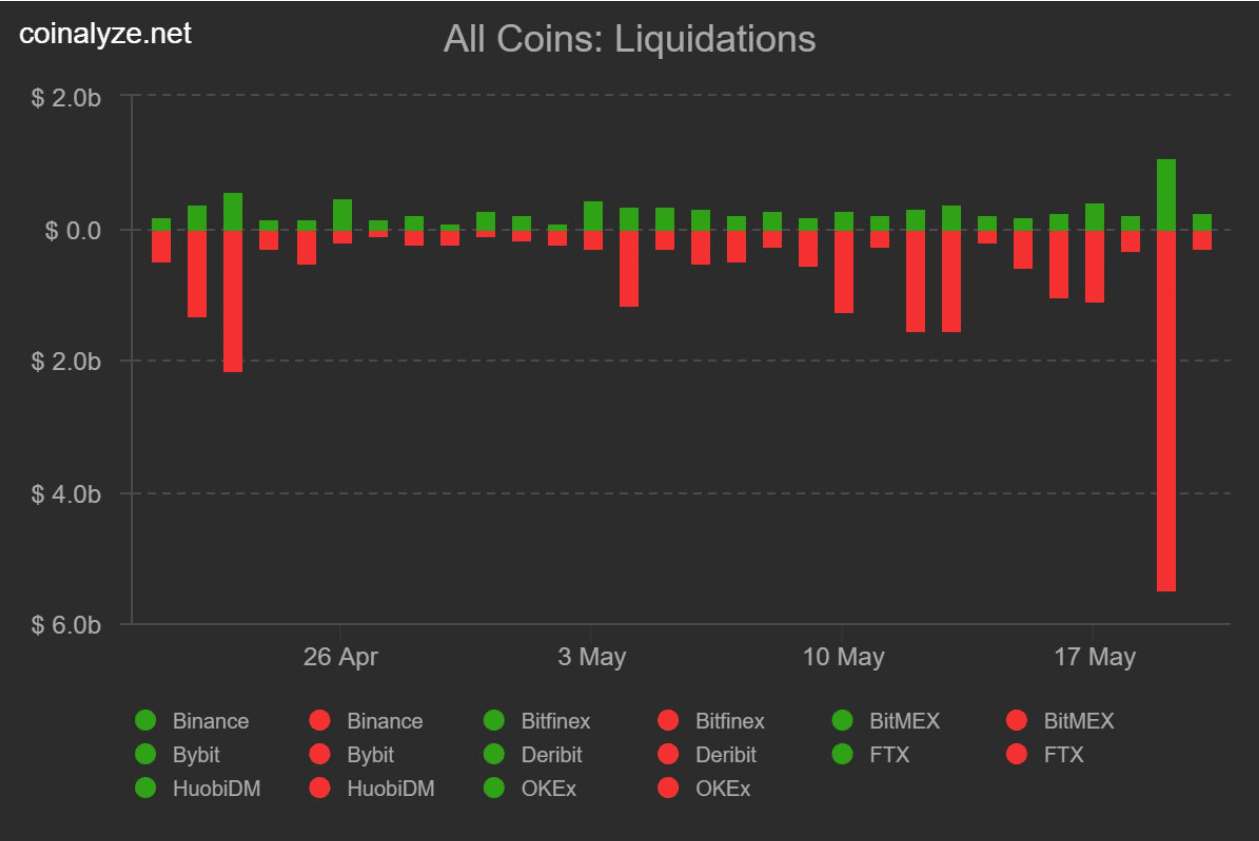

The crypto market has been overheated for a long time but the denouement has only now come. It turns out that the correction coincided with a fall in the traditional financial markets, which significantly accelerated its pace. Instead of a systematic decline, we got a sharp collapse. Bitcoin fell by $15,000 in 24 hours, leading to panic and liquidations.

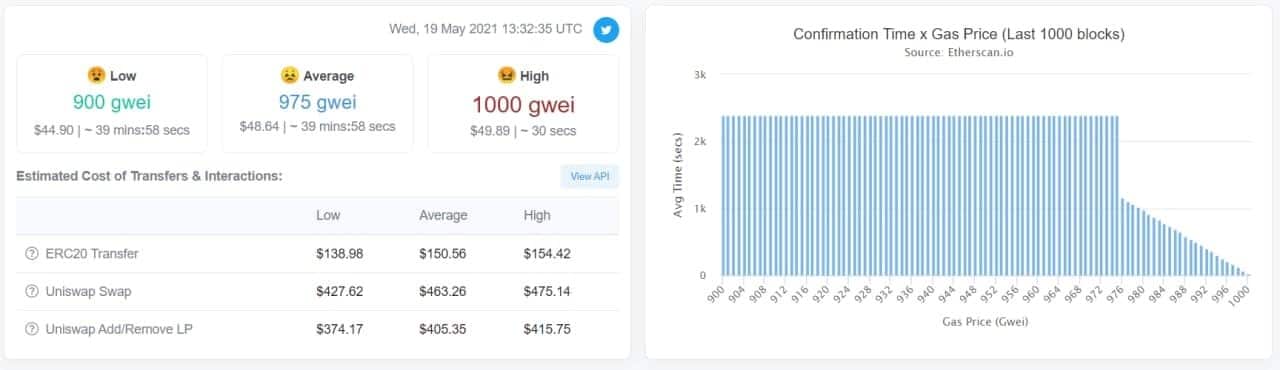

BTC’s fall set off a chain of imminent events. Users began to sell off their crypto assets in an attempt to lock in minimal losses, which led to an increased load on the Ether network and centralized platforms. The price for ERC-20 token transfers reached $150. Nevertheless, DEXs continued to function normally, which cannot be said for CEXs.

The centralized betrayal

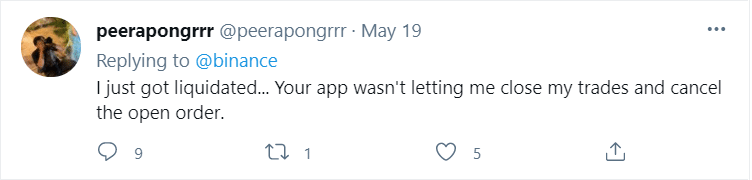

Large centralized exchanges resorted to the only correct choice (in their opinion), which was to block the possibility of withdrawing funds, citing ‘network instability’ as justification. On the one hand, this is the only way to keep clients’ assets. On the other, it’s a dirty show of power that damages their reputation. This is what Binance did with no regrets. Many users couldn’t even operate normally within the exchange, which led to liquidations and the inability to buy assets or use futures.

The same situation happened across all CEXs, even with the biggest players like Coinbase and Kraken.

What’s up with DEXs?

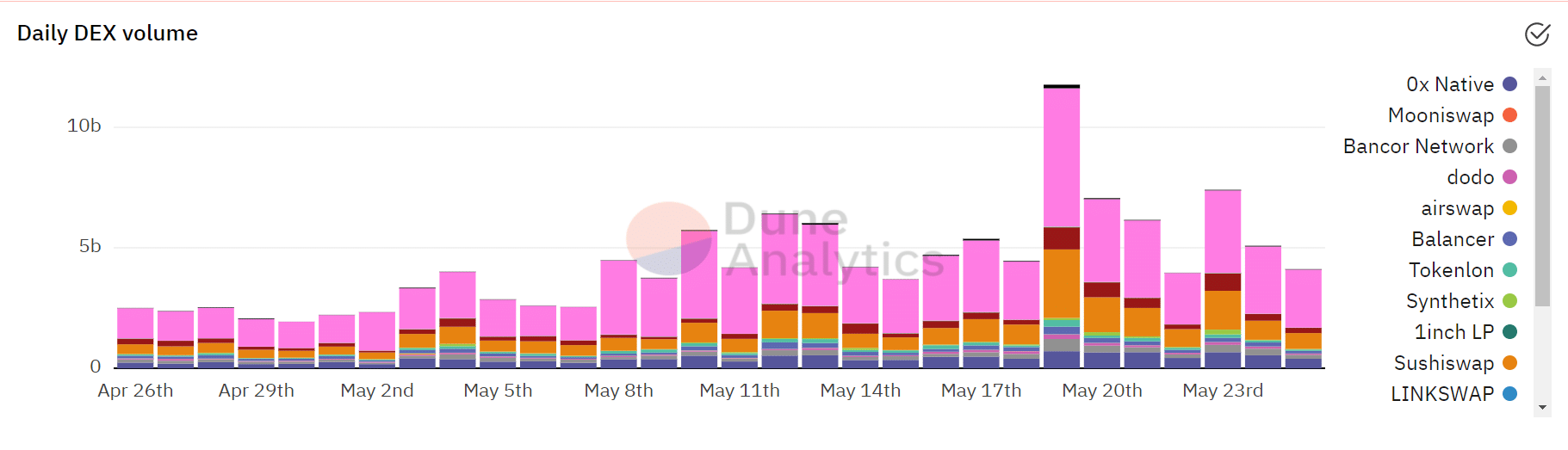

Despite the fact that the total value locked in DeFi protocols dropped from $140 billion to $70 billion, none of the DEXs stopped doing their job. It was actually the correction that highlighted the difference between centralized solutions (where a conditional CZ can block any withdrawals) and decentralized ones. Despite high Gas fees, DEXs like Uniswap, SushiSwap and Alium Swap continued to function smoothly.

DEX volumes reached an all-time high on May 19th at over $10 billion. While CEXs were imposing restrictions, DEXs provided freedom.

DeFi provides variability

March 2020 seemed like a nightmare but let’s face it – DeFi was just in its infancy. Objectively speaking, the current fall is unfolding much smoother. Flash loans and DEXs helped users to bypass the restrictions of centralized services. Decentralized finance creates flexibility.

Going up?

The community witnessed huge pressure on Bitcoin’s price. China has once again pushed the ‘ban BTC’ button, Elon Musk has criticized Bitcoin but now the FUD has subsided. Slowly but surely, the crypto market is going up. BTC is trading at $39,000, ETH is back at $2,800. What could go wrong?

Actually, a lot of things:

- Another FUD would send coins to even lower levels.

- There’s a chance of decline in the traditional markets as US investors are unsure about the long term recovery.

- Bulls’ weakness could continue (maybe we’re already in a bear market).

Despite any of the aforementioned scenarios, DeFi will still stand and defend the crypto community, as will Alium Swap. With the emergence of the MultiChain DeFi protocols with CrossChain bridges, like Alium Finance – there is a clearly superior alternative to Centralized exchanges in these turbulent times. More Decentralized and Stress Resistance, the Future of Finance is here.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.