Curve Finance Review – Is Curve Finance Scam or Legit?

Curve Finance Review

Decentralized finance gained wide adoption before the launch of the Ethereum network that made it easier to achieve complex financial use for making profits aside from just simple transactions. Below we discuss a Curve Finance exchange review as to why it is climbing so fast on the DeFi rankings and why you should consider it as a platform for you to invest or trade on.

Unlike traditional financial institutions whose existence relies greatly on centralized intermediaries to provide financial instruments. Decentralized finance does not rely on intermediaries to provide financial instruments.

Fluctuations in market values account for a lot of profits made during trades, and also losses of course. Taking full advantage of the differences between financial instruments to make a profit requires one to make transactions as fast as possible before the market reverses. Hence the importance of having a speedy exchange.

Normal online exchanges ease and speed up the exchange of currencies for other currencies. Decentralized exchanges take this to another level, offering super fast and super cheap exchange by connecting users directly to trade currencies.

You need anonymity, you need security and you need speed when making an exchange. All these accounts for lesser risks. DEXs makes all these possible by utilizing smart contracts on Blockchain to make swaps possible thereby eliminating the need for brokerages, exchanges, or banks to offer financial instruments.

There are lots of decentralized exchanges out there offering similar services but through different means. This review digs into the pros and cons of Curve Finance DeFi protocol, providing what you need to know to fully utilize it as your trusted decentralized exchange.

Overview

| Exchange platform | Curve Finance |

| Exchange type | Decentralized |

| Website | Curve.fi |

| Variety crypto | 23 |

| Supported crypto | DAI, USDT, TUSD, BUSD, USD, different BTC pairs |

| Account needed | No |

| Verification | N/A |

| Trading Platform | Web-based |

| Payment Method | Cryptocurrency |

| Fiat | N/A |

What is Curve Finance?

Curve Finance is one of the largest DeFi (decentralized finance) platforms with headquarters based in Switzerland. Founded by Michael Egorov and launched in January 2020, Curve Finance is a decentralized exchange (DEX) built on the Ethereum cryptocurrency network that focuses on exchanging stablecoins and other stable pairs at a low fee and minimum slippage using an Automated Market Maker (AMM) protocol.

Boasting as a DeFi platform for both traders of cryptocurrencies and providers of liquidity, Curve Finance rewards you with interest for crypto held in your wallet after you have made an exchange and also rewards users who provide liquidity to the decentralized pool of token that it operates on. Providers of liquidity for the platform get a portion of the exchange token fees and claims of the native governance token, CRV, and also an extra share of earnings from Curve Finance integrating their liquidity pool with some third-party DeFi projects.

Speed, efficiency, and continuity are very vital to the success of an exchange and Curve Finance ensures this by incorporating the use of a decentralized liquidity pool and an automated market maker (AMM) protocol to swap between coins and reinforce the liquidity of its markets. This eliminates the need to match a buyer to a seller for an exchange to take place. Instead, a buyer or a seller makes trade exchange in or out of the liquidity pool.

With just under two years of existence, the ease of upping the rankings has portrayed the increasing potentials of Curve Finance in terms of usage, authenticity, and adoption. As of August 2020, just months of operating, the exchange boasts of over $1 billion worth in deposits, running a daily trade volume of over $60 million.

If you were to trade on the exchange today, your assets will be among over $10 billion deposits so far on Curve Finance. That is incredible growth and popularity over a short period. There is a high level of peace and confidence trading on the platform knowing there are hundreds of millions of trade volumes being exchanged and that you can have a share of about $1 million that is being paid out every week to CRV holders.

What is an Automated Market Maker?

An automated market maker is a Blockchain protocol that determines the price of assets By making use of smart contracts rather than an order book. When starting a liquidity pool, providers of liquidity are expected to provide two trade pair crypto in equal ratios.

Curve Finance CRV Token

CRV is a token developed by an independent developer and later adopted by Curve Finance to govern its platform. Having a value over $50 per token when it was first launched, CRV now values at $1.7 per token suggesting its unstable nature.

Suppliers of liquidity on Curve Finance are paid their percentage of the exchange fee profit in CRV.

Locking or holding CRV for some time generates veCRV (vote escrowed CRV) as interest for the holder. This represents the voting rights of users on the platform. CRV can be locked for a period of 1 to 4 years. CRV is Curve Finance’s governance token that serves as the unit of power in the decentralized ecosystem.

Curve Finance DAO

Curve Finance, in a bid to have a highly decentralized governing system where decisions affecting existing policies and the making of new ones are done by the users of the exchange, launched a Decentralized Autonomous Organisation (DAO) in August 2020 that has all vital information regarding the status of the protocol made public for all to see. The CRV token serves as the unit of power in this decentralized government where the users of the platform now have the power to effect necessary changes through voting rights that depend on the amount of veCRV each user has.

As said earlier veCRV is gotten when users hold CRV or other pool tokens. The amount of voting rights that can be gotten, depends on how long the token is held and which token is been held as they have varying voting rights returns as displayed on the DAO page on the website.

Curve Finance Trading Services

Curve finance owes its growth to how it differs from other DeFi protocols in terms of how it goes about its trading services. The platform’s algorithm unlike others which focuses on maximizing their liquidity focuses on minimum slippage during exchanges through a speedy transaction and also low fees.

Trades and orders are placed at very fast speeds on the platform. The automated system used by Curve Finance cuts down the effect of price fluctuations on the value of the user’s about to be purchased assets.

With a large number of liquidity pools to select from, Curve Finance also offers Yield farming with very generous interest rates.

Curve Finance Fees

Curve Finance from the very first step charges you no fees for signing up and using their services on their website. So you do not have to worry about any one-time sign-up fee, all you just need is an ethereum base wallet, fund it, and you can have access to all the services they provide.

Lower fees are the target of Curve Finance and they have gone to great extents to ensure they achieve this and it stays so. During transactions, Curve Finance does not charge any fee for the platform itself aside from the network fees which are meant for the miners of that crypto that work behind the scene to make the transaction possible.

There is a huge cut in the transaction fees when swapping on Curve Finance. This is because Curve Finance operates a direct swap between stable coins, eliminating the huge extra transaction fee that comes from using a base crypto as a standard for swapping between tokens. This means that instead of converting the token to be swapped to its current value of Ethereum first, before converting from Ethereum to the desired token, Curve finance just swaps from one token to another without any intermediary, all thanks to its ever-ready liquidity pool.

A good exchange should not just give you high returns but also charge lower trading fees on the4 amount you intend on investing. Imagine spending almost half of your capital on fees and left with very little to invest at the end of the day; not an experience to look forward to. On Curve Finance, traders save more with a little swap fee of 0.04%, considered to be one of the most efficient on the Ethereum network, being charged per transaction and its direct swap function. This highlights the platform to be a good decentralized exchange.

Like earlier said, Curve Finance is all about low fees and this is reflected greatly in their trading algorithm. Curve Finance designed its algorithm to focus more on minimizing the slippage that arises when trading pairs, unlike other Decentralised Finance protocols that seek to maximize the available liquidity. And as you already know, less slippage means less cost incurred.

Curve Finance Withdrawal and Deposit Fees

Before making a deposit, it is important to note that Curve Finance does not accept fiat currency deposits, so you need crypto holdings from an entry-level exchange to be able to make your first crypto purchase on the platform.

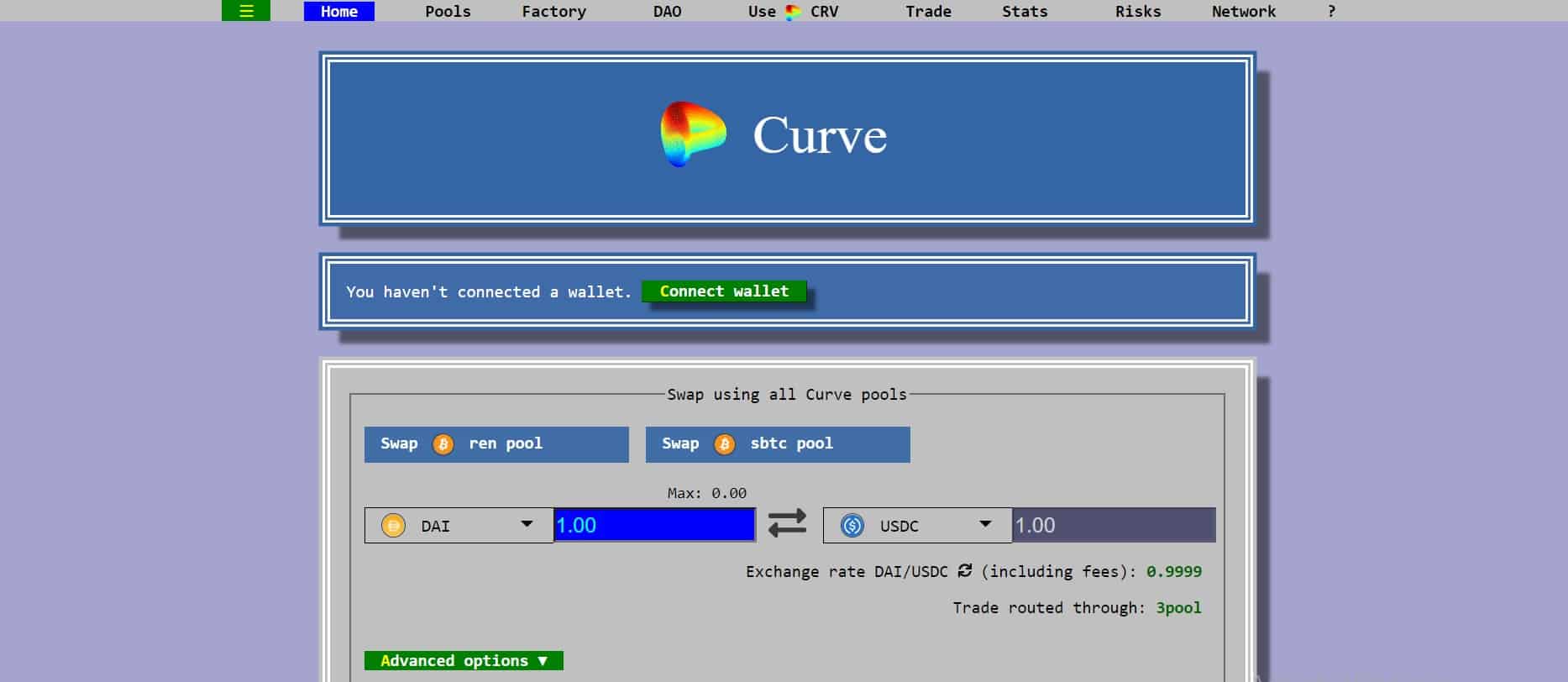

When you open the Curve Finance website, the first thing that pops up is a request asking you to choose your wallet. This means that before creating an account and swapping for a supported token on the platform, you need to create a web 3.0 Ethereum wallet. This is where you make your deposits and connect to the exchange to make your first exchange.

Deposit and withdrawals on Curve Finance incur fees from between 0% and 0.02% of whatever is been deposited or withdrawn depending on whether the deposit and withdrawal are done in imbalance or not.

Undergoing constant changes from continuous deposits, withdrawals, and swaps, the distribution of tokens within the liquidity pool on Curve Finance is not always equal. When a traders trade against the pool, tokens are either added or removed from the pool depending on which action was carried out. This affects the pool balance and in other to restore balance, Curve Finance offers incentives on deposits and withdrawals that will favor the restoration of the pool balance.

Balanced deposits and withdrawals which do not affect the pool are free, incurring 0% fees. This is enjoyed by users that deposit and withdraw tokens in the same quantity or proportion as to what is in the pool. A deposit or a withdrawal of a single token will cause an imbalance in the pool and as a way of reducing such transactions, it comes with a fee.

Cryptocurrencies Available on Curve Finance

Curve Finance has been able to amount to a high trade volume of about $3.3 million in the 24 hours cycle. Focusing mainly on stablecoins to achieve its target and run smoothly, the platform still offers varieties to choose from and trade from.

Currently, Curve Finance supports many currencies, about 23 coins amounting up to 65 trading pairs. Among these are USDT, DAI, Liquidity USD (LUSD), TerraUSD (UST), USD coin (USDC), and also different BTC pairs like the Huobi BTC

Trading pairs include ETH/STETH, DAI/USDT, LUSD/USDC, UST/USDT just to mention but a few.

Curve Finance interface

With a more Retro look, Curve Finance stands apart from other exchanges. A simple interface though not of the best of looks, but designed to make navigation and interactions easier when using their website.

How secure is Curve Finance?

Security plays a very vital role when it comes to finance and investments. Nobody wants to put their hard-earned funds in a place where they are not sure is safe. You want to make profits on your investments, not wake up one morning and discover that all your money is gone.

Self claims are usually not enough proof, the words of trusted names go a long way in building up trust. Which why Curve Finance has had their smart contracts audited many times by top security companies to ensure all necessary security measures have been taken, modifications made and features that close the security gap are developed.

Curve Finance has been audited by Trail of Bits, a company that is an expert in reverse engineering, malware, and software exploits among others, having provided software security services for top apps like Facebook and DARPA.

Quantstamp, a leading blockchain security auditing company that has secured over $5 billion worth of value on blockchain applications for some top crypto companies has also audited Curve Finance smart contracts.

By these audits by Trail of Bits and Quantstamp, so many security measures have been taken, making Curve Finance a safe space to trade.

Of recent, DeFi projects have been a target for hackers with eyes fixed on stealing from liquidity pools. A lookout for safety and security on Curve Finance is the streak of having held several millions of dollars worth of value for many months now.

There are always potential risks associated with online trading platforms and Curve Finance is not in denial of this, but rather points it out clearly and is constantly taking steps to find and fix any potential security issue upfront.

Aside from running a bug bounty program with rewards up to $250,000 to anyone that can find point out bugs that can lead to substantial loss of money, Curve Finance uses a one transaction feature to further thwart attacks from hackers. This reduced the speed at which it can be possibly hacked giving time to defend itself.

The exchange clearly states on their website that “Security audits do no remove the possibility of some vulnerability being found in the Curve smart contracts. Getting high returns always comes with risks and risks cannot be eliminated.

Joining a pool on the exchange means you are accepting the risks associated with the pool. It is wise to check and research the risk you can tolerate before making a decision, to know where you can get the lesser risks pertaining to you.

You are responsible for holding your assets on a DEX. Curve Finance has taken towards securing your assets by being a non-custodial platform. This means aside from the liquidity pool it has no direct access to the cryptocurrency of the users. So do not worry, your funds are safe in your wallet, away from hackers if they were ever able to hack the exchange.

Curve Finance customer support

There are no dedicated platforms to handle customer support as the users are also those running the platform. However, Curve Finance has a FAQ section on the website to walk users through different inquiries from tutorials on how to begin using the platform, to make deposits, and other answers to questions regarding how everything works.

There is also a dedicated Twitter account, a telegram page, and channel, and a discord account to inform users of the latest as regards the platform

Conclusion

Coming into the game with a lot of potentials and having pushed through the rankings speedily to become a leading DeFi protocol, Curve Finance has proven to be the best DEX to adopt if you are going into trading liquidities.

Standing apart from other decentralized exchanges, Curve Finance utilizes a unique algorithm and approach to give a satisfactory experience that can only be gotten on the platform. It offers the lowest fees and high interest on deposits and liquidities.

Aside from having just limited pairs to swap, Curve Finance is heading towards becoming a power in the decentralized exchange market. Looking to support beyond just stablecoins in the future, we are looking at a high potential DeFi protocol.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.