Bitcoin Price Value Faces a Loss Of $1400 in Just One Week: What is Ahead Now Bear Market or Bullish Market?

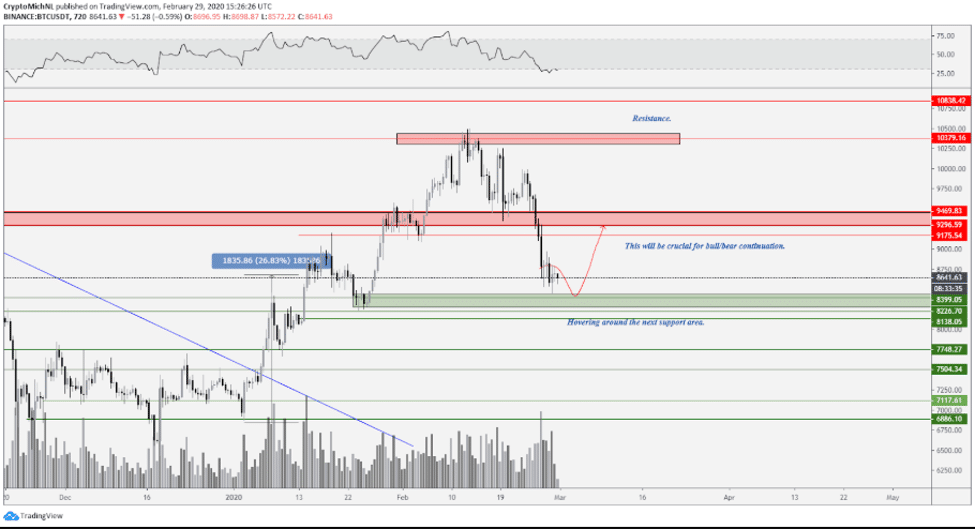

According to a BTC/USD 12-hour chart, if the current situation becomes bullish for Bitcoin, then it would start a rally towards $9,200-9,400

The cryptocurrency and Bitcoin markets faced a big sell-off this week. The fear of potential economic stability led people to sell their assets. Therefore, the markets faced this huge sell-off. Along with cryptocurrencies, Gold and silver which are known as safe-haven assets also faced a big sell-off on Friday.

Now the upcoming few weeks are very crucial for the cryptocurrency markets because in this time period either the markets will find some kind of support or they will start a downtrend momentum.

Sell-off occurred as Bitcoin could not find support at $9400

The $9400 level has been a key support level for Bitcoin. The world’s leading digital asset needed the support of this level when its price value was seeking resistance at the $10,400 level. However, when this support level was tested, it failed to provide support to Bitcoin and the price value of the coin came down below this level. Because of this, the whole market saw a massive sell-off.

The next support after this sell-off is now standing at $8,200-8,400 and right here several horizontal levels are offering temporary help for the short-term rally. For some people, the short-term upward momentum is vanishing from the market. The reason is that the price value of the leading asset is recording a lower low at the moment on the daily timeframe.

Is it referring to a bearish trend ahead for the cryptocurrency market? This is not going to happen because as of the 1st January 2020, the price value of the coin is still trading 27% higher. This means that the leading asset is still among the best performing digital assets of the year.

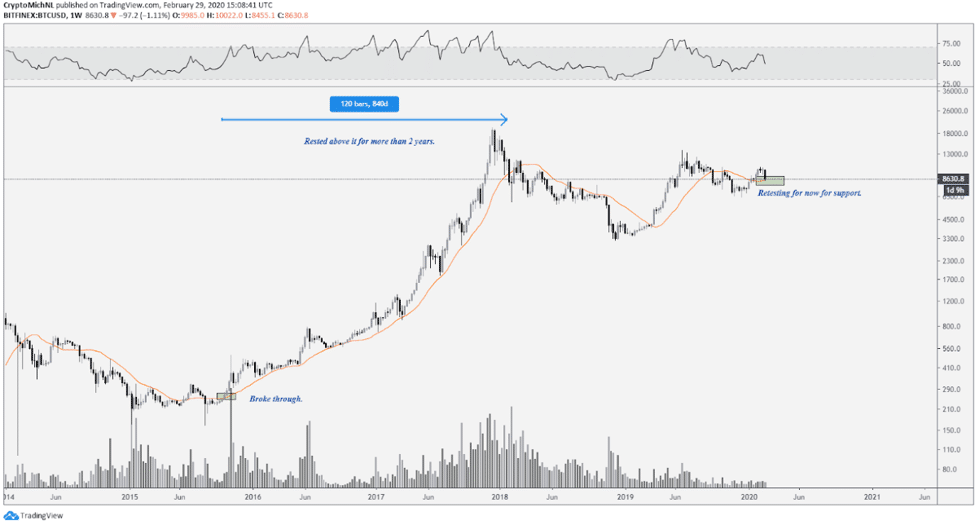

BTC/USD Weekly Chart relies on the 21-week MA

The 21-week Moving Average remains to be the most important factor and a key indicator for Bitcoin bulls as this level provided much support to the last bull cycle and as a result, a strong bullish rally occurred in December 2017.

Now the BTC/USD weekly chart is depending upon the 21-week Moving Average. The current situation is that if Bitcoin’s price manages to find support at this level, then a bullish momentum is expected to continue in the near future.

However, if the price value of the leading asset fails to discover support at the $8400 level, then it will have to find support at $7,500-$7,700.

What are now the Bullish and Bearish Scenarios for Bitcoin?

According to a BTC/USD 12-hour chart, if the current situation becomes bullish for Bitcoin, then it would start a rally towards $9,200-9,400. However, Bitcoin could only begin this relief rally, if it succeeds to gain support at $8,250-$8,400.

If Bitcoin wants to break the resistance of $10,400, then it first needs to break the resistance at the $9,200-$9,400 which will then act as a support level for Bitcoin and will help the coin to reach near the $10,400 level.

Well, there are no prominent signs of a bearish trend for Bitcoin in the upcoming days. However, if the price value gets rejected at $8,950 or $9,175 then it will once again test the support at $8,200-$8,400. And if it does not get sustainable support here, then it will move down showing a bearish trend.

Altcoins are also looking for support

The situation of altcoins is no different from the other market. Altcoins are also looking for support as a huge rejection occurred at the horizontal level at $115 billion.

For them, the most important level is around $73-$75 billion. If Altcoins are able to find support at $73, then they would make higher low and as a result, the upward momentum is expected to continue

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.