Bitcoin under $8k: Possible Reasons behind Ongoing Bearish Mood

Bitcoin goes deep down and even below the hope level of $8,000. Currently, its price value is hovering at $9,965. The Bakkt volume of today is pumping which means that institutional traders don’t have any concern with BTC bearish suspension around $8,000.

The ongoing month has not yet proved very fortunate for the digital gold as we have not yet seen any rally that has the capacity to relieve the bearish trend. On Thursday, the value dropped below $8,000 towards $7,982 for the first time in a month. But the present condition is against the Bitcoin as it clinging at $7,965 at the time of writing.

Reasons behind BTC Ongoing Drop Level

There can be many reasons but some are more obvious than others and seems to be the cause for the current position of digital gold. Mining capitulation is the leading cause as small level miners are leaving the space and creating an atmosphere of selling pressure. Cole Garner, who is a crypto analyst argued that mini miners are fed up from the BTC mining because it is too difficult for them to meet the expenses.

At the end of October, everyone saw that bitcoin short term rally has reached a record level and such kind of daily run is noticed after 2011. This sudden rally came after the Chinese’s President, Xi Jinping, has expressed a great interest in the blockchain industry. People overreacted on this and short term surge observed but now, the value has returned to its normal position to which it belongs.

Analysts are expressing mixed sentiments over the next targets of the BTC as according to DonAlt, some people are passing comments for $3k and some for $14k but the middle ground is the real goal point.

People talking about $3000 right now are being more unreasonable than people talking about new highs.

A run from $200 -> $20k is going to take some time to digest.

$3k was an overreaction to the downside.

$14k was an overreaction to the upside.

We're now finding middle ground.— DonAlt (@CryptoDonAlt) November 21, 2019

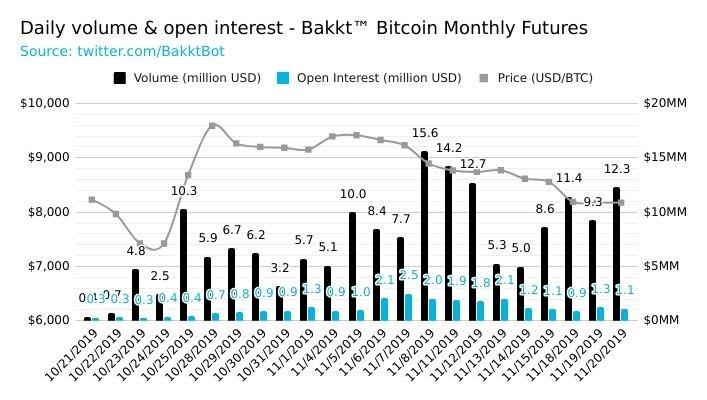

Bakkt volume is Accumulating

BakktBot’s data show that volume is uprising besides the downfall of coin value. Futures contracts of almost 12.3 million done on Nov.20.and the traded volume of the past 2-3 days unveiled that more and more institutional investors are putting money in digital gold- knowing the fact that its price is going down. This shows that they have something in their minds which will definitely become clear in the next coming days.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.