Nexo.io Review [2020] Instant Crypto backed Loan Platform

If you are a crypto owner and want to buy something or in need of some cash then don’t worry; we are here to help to get some loans. With this loan, you can buy anything without losing your ownership of digital assets. You just need to transfer your crypto assets to the Nexo wallet as collateral and get your desired loan.

So, get ready and be attentive, we are going to tell you everything you need to know about Nexo, a crypto-backed loan platform.

What is Nexo?

Nexo is a lending platform that offers loans and used crypto assets as collateral. Nexo is developed using the decentralized technology called in order to meet the needs of the crypto community.

Nexo is backed by a prominent Fintech group called Credissimo that is serving the online finance ecosystem from the past 10 years. There is almost $187 million worth of loans has been granted by Credissimo in ten years. We can estimate the success of Credissimo from its achievements as it has received Forbes Business Awards 2017 for bringing innovations in the finance industry.

After the great success Credissimo, they have launched the first instant crypto-backed loan platform in 2017. Besides, offering loans, Nexo is serving the crypto community for other trading options such as selling, buying, futures, and swaps.

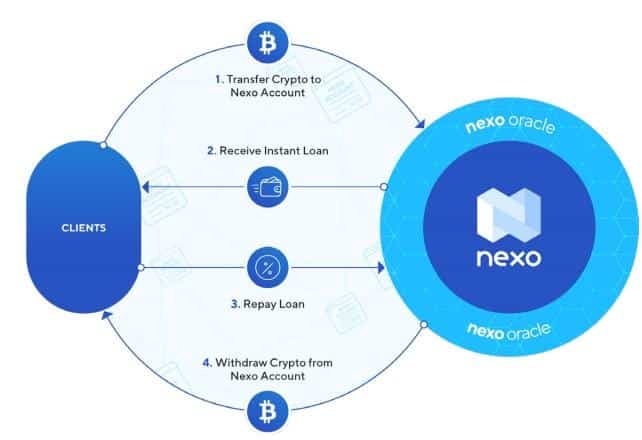

How the Business Model of Nexo work?

There is a simple procedure about how the company interacts with its clients. The whole process is divided simply into four different steps or phases. After understanding these steps in detail, you can easily utilize the services provided by the Loan Company Nexo. We will explain to you in a very simple way, so let’s ready and have attention.

1. Send your digital assets to Nexo Account

After doing all the necessary things required to open an active account, you will build a bond of trust with the firm. It’s time to deposit the crypto assets from your personal wallet to the Nexo wallet. This amount of your crypto assets will be sent to the Nexo account as collateral.

Once you submit your cryptocurrency, you will have to wait until the blockchain of the platform confirmed your collateral assets.

2. Receive Instant Loans in Desired Fiat Currency

Your instant loan will be available after the calculation of the LTV of your submitted crypto. The limits will depend upon the nature of digital coins. The limit will be low if the coin is more volatile and have greater chances of risks. After the limit is calculated, you can get instant loan in your desired fiat currency. Similarly, there are various methods to withdraw your fiat currency as a loan such as Free Nexo Card or bank accounts. This will depend upon your needs and conditions.

3. Repayments of Loan

In comparison to other rival platforms, Nexo is offering the services of flexible repayments. There are many ways to repay the loans. For example, you can repay through fiat, cryptocurrency and also with your collateral digital currency. The client doesn’t need to do the monthly repayments but it depends upon the client’s balance in the wallet. One can repay the loans in small portions or all at once, which makes the platform more flexible. The interest rate will be decreased by 50% when using Nexo tokens for repayments.

4. Withdrawing of Crypto Assets from Nexo

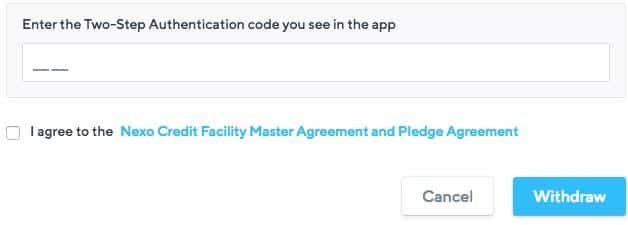

If you want to withdraw your crypto assets back, you can easily withdraw them by repaying the loan along with the interest rate. You can withdraw some portion or all digital assets at once.

How to Get Instant Loan?

One can get a loan in fiat currencies within a short period of time as Nexo provides instant loans. In order to withdraw your loan, you will have to go through the following steps.

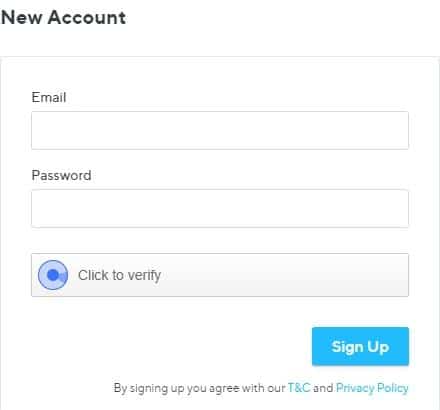

Step#1

First of all, you have to create an account by giving some basic information such as your Email address.

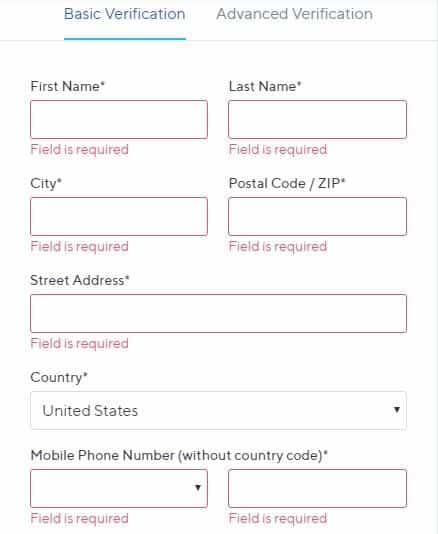

Step#2

After the successful creation of the account, the next thing is to go through the process of KYC. Your deposits and withdrawal limits depend upon the level of verification.

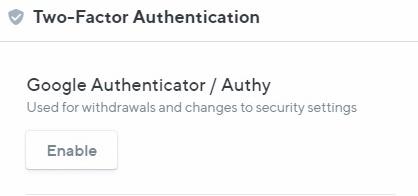

Step#3

You will have to enable the Two-Factor Authentication for more security.

Step#4

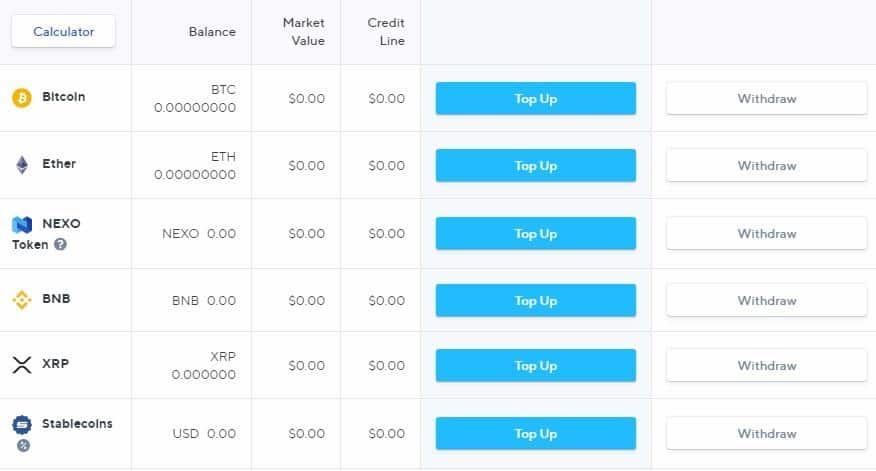

Now it’s time to deposit the crypto assets in the Nexo Wallet. You can choose the cryptocurrency listed on the dashboard of the platform.

Step#5

Finally, you are able to withdraw your loan in your desired fiat currency.

Limitation Based on the Types of Verification

Your assets are secured on the platform as these protected with the hard of security walls. In order to use the services, the first step is to verify your account which is executed though KYC/AML. This is very important as it prevents from unauthorized access and keeps the assets secure. KYC processed with the assistance of Onfido, an efficient KYC company, and complete the whole process within minutes or in 24 hours in some cases.

There are three types of Accounts available based on their verification and level and limitations as well. However, there is no limit on deposits in all these types of accounts.

1. No Verification

You can withdraw $20,000 in one day without verification. However, one cannot withdraw through bank without doing verification.

2. Basic Verification

By providing basic information to the company, you can withdraw up to $20,000 per day. Like above, you have not access to withdraw through bank.

3. Advance Verification

There is no limitation and deposits as well as withdrawing of crypto assets. Client can withdraw up to $200,000 in just one month. This limit can be increased up to $2,000,000 in some particular conditions.

Why Nexo is a Better Option?

There are many platforms operating in the crypto community regarding lending services. But Nexo is somewhat different and a secure company that is offering crypto-backed loans. On the Nexo platform, one has full ownership of his or her assets as well as their generated profits. There are no credit checks at all and there is no concept of tracking the client’s credit line.

There are no additional or hidden fees at all and all the processes can be fully monitored by the client. As compared to other lending firms, the interest rate is also very competitive. One striking feature of the company is that it is a worldwide platform and there is no restriction for any country at all.

Most of the lending companies can allow one currency for repayments. But Nexo firm allows five different options such as USD, EURO, BTC, ETH, and NEXO. Moreover, it also offers dividends and distributes 30% of the profits to the NEXO holders.

Nexo Card

Nexo is providing Nexo Master Card for its users to enjoy a better experience with multiple options. You can manage the Card by activating the Nexo Mobile application and get the credit line access at your finger-tips.

The Nexo wallet is linked with Card and Nexo Oracle monitors all the activities and approved the transactions worldwide.

You can get 5% cashback when payments are done with Nexo Card and this cashback will automatically go to the Nexo Wallet and increasing your balance. It is very easy to freeze and unfreeze your card and additionally, one can also generate the virtual cards for more security.

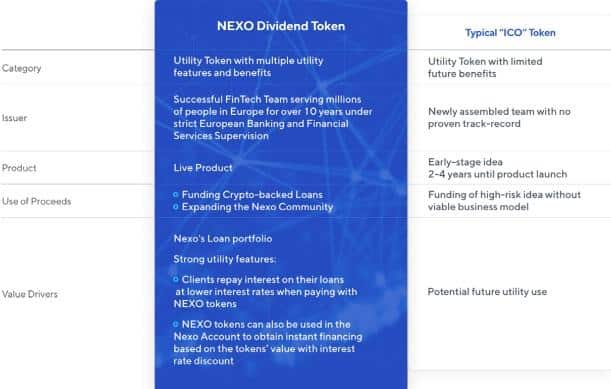

Nexo Token

Nexo token is ERC20 compatible and its smart contracts will be done using the blockchain of Ethereum. The token is issued under the US regulation as its backed company is also working under the US regulations. This ensures the reliability and the credibility of the platform as well as its token.

Unlike other tokens, the Nexo token holders receive 30% dividends. It means 30% profit of the company goes to Nexo token holders that distributed through BTC, Eth, Nexo token and USD stablecoin.

Distribution of Tokens

- 52.50% out of all tokens will be distributed among Nexo Investors

- 25% of tokens will be used in the growth and adoption of loans.

- 11.25% tokens will go to the founders and team of the firm.

- 6% tokens will be allocated to build community and for Airdrops.

- 5.25% tokens will be allocated to Nexo’s advisors.

Supported Cryptocurrencies

Nexo supports following cryptocurrencies:

BTC, ETH, LTC, XRP, NEXO, BNB, Stellar,

They are planning to add more coins in future.

Supported Fiat Currencies

Nexo supports following fiat currencies:

Emirati Dirham (AED), Argentine Peso (ARS), Australian Dollar (AUD), Bulgarian Lev (BGN), Canadian Dollar (CAD), Chilean Peso (CLP), Chinese Yuan (CNY), Czech Koruna (CZK), Danish Krone (DKK), Egyptian Pound (EGP), Euro (EUR), Pounds Sterling (GBP), Georgian Lari (GEL), Ghananian Cedi (GHS), Hong Kong Dollar (HKD), Croatian Kuna (HRK), Hungarian Forint (HUF), Indonesian Rupiah (IDR), Israeli Shekels (ILS), Indian Rupee (INR), Japanese Yen (JPY), Kenyan Shillings (KES), South Korean Won (KRW), Moroccan Dirham (MAD), Mexican Peso (MXN), Malaysian Ringgit (MYR), Nigerian Naira (NGN), Norwegian Krone (NOK), Nepalese Rupee (NPR), New Zealand Dollar (NZD), Peruvian Sol (PEN), Philippine Peso (PHP), Pakistani Rupee (PKR), Polish Zloty (PLN), Romanian Leu(RON), Russian Ruble (RUB), Swedish Krona (SEK)

Nexo Advantages

- Clients have 100% ownership of its assets

- Free Nexo Card

- Competitive Interest Rate

- Secure and Reliable

- Backed by Fintech group Credissimo

- Instant Loan

- Wide range of fiat currencies

Conclusion

If you have security phobia in choosing a lending platform then it is the best Loan firm for you. First of all, it is based on the blockchain technology and decentralization makes it more secure. Secondly, you verification is done through most advanced KYC process. Thirdly, two-factor authentication makes it more reliable company in the crypto finance industry.One can access Nexo from from every corner of the world as it is a worldwide firm.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at [email protected] if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. CreditInsightHubs is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.